Easier than Excel: Budgeting Apps

If doing your taxes this year has caused you to take a closer look at your finances you may be raising an eyebrow, and questioning your spending habits. Budgeting is a great way to keep you financially on track, and not indebt yourself to Starbucks. That being said, the best of intentions are often abandoned when faced with a complicated excel spreadsheet, and a busy semester of classes.

Budgeting can be much easier and more rewarding with a few simple tech integrations. A host of apps have been developed to streamline budgeting and help you track your financial goals. They range from providing simple envelope style allocation, to complex charts and graphs showcasing spending. Check out a sampling of the options below:

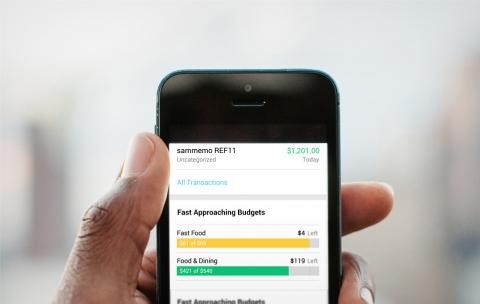

Mint

This is one of the most popular budgeting platforms out there, and for good reason. The sleek interface allows you to link all of your accounts and create a complex budget. It then tracks your income and expenses and allocates them into budget categories. You can set limits for spending, and the app will alert you when you are nearing them. It will also link to any saving or retirement accounts you may have, allowing you to track and automate your savings goals. This app lets you see the big picture of your finances; all of your accounts in one place. Check it out here(link is external).

PocketGuard

If you are looking for a more simple, streamlined look at your finances, PocketGuard(link is external) could be a great choice. It connects to your accounts and shows in simple terms how much money you currently have, earned, and spent. It will also track your spending to help identify recurring payments that you should account for. In addition to the mobile app, it is also available on apple watch, allowing you to never be without your budget.

Level Money

Can I buy this and still stay on track? We all ask this from time to time, and Level Money(link is external) gives you a simple answer. The homepage of this app links to your bank accounts and shows three numbers; how much you can spend today, this week, and this month. It is a streamlined approach to help you understand your limits, and can be great if you are prone to impulse buys.

Unsplurge

Big purchases aren’t a bad thing; enjoying the money you make is also a part of successful budgeting. Unsplurge(link is external) allows you to create savings goals for big purchases or vacations. It can be motivating to visually see your goals, and track your progress in real time. If you are struggling to save, a community of members is available to encourage you, and provide tips and tricks to help you be successful.

Technology can make many arduous tasks a lot more pleasant, and this is true for budgeting as well. Let us know which of these apps you have tried, and what works best for you!